Redistribution of wealth

Redistribution of wealth is the transfer of income, wealth or property from some individuals to others caused by a social mechanism such as taxation, monetary policies, welfare, nationalization, charity, divorce or tort law.[1] Most often it refers to progressive redistribution, from the rich to the poor, although it may also refer to regressive redistribution, from the poor to the rich. The desirability and effects of redistribution are actively debated on ethical and economic grounds.

Contents |

Types of redistribution

Today, income redistribution occurs in some form in most democratic countries. Progressive income redistribution diminishes the amount of income one individual or corporation receives, while at the same time benefitting others. In a progressive income tax system, a high income earner will pay a higher tax rate than a low income earner. A steeper progressive income tax results in more equal distribution of income and wealth across the board. The difference between the Gini index for an income distribution before taxation and the Gini index after taxation is an indicator for the effects of such taxation.

Property redistribution is a term applied to various policies involving taxation or nationalization of property, or of regulations ordering owners to make their property available to others. Public programs and policy measures involving redistribution of property include eminent domain, land reform and inheritance tax.

Two popular types of governmental redistribution of wealth are Subsidies and Vouchers (such as food stamps). These programs are funded through general taxation, but disproportionately benefit the poor, who pay fewer or no taxes. While the persons receiving redistributions from such programs may prefer to be directly given cash, these programs may be more palatable to society, as it gives society some measure of control over how the funds are spent.[2] See Figure 1 for an example of how a subsidy for a good (Good Y in the figure) will increase the amount of the subsidized good purchased by a greater portion than it increases the amount of the non-subsidized good purchased (Good X), as a result of the substitution effect.

Supporting arguments

| “ | Money is like muck, not good except it be spread. | ” |

|

—Francis Bacon, 'Of seditions and Troubles', Essays, 15. |

||

The objectives of income redistribution are varied and almost always include the funding of public services. Supporters of redistributive policies argue that less stratified economies are more socially just.[3]

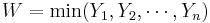

One basis for redistribution is the concept of distributive justice and wealth. One premise of redistribution is that money should be distributed to benefit the poorer members of society, and that the rich have an obligation to assist the poor, thus creating a more financially egalitarian society. This argument rests on the social welfare function, or the concept that society’s utility is made up in some way through the utilities of its individuals. Particularly the Max-Min or Maximin Criterion for social welfare explains this concept:

This states that the utility of society (W) is dependent on that of the least (min) individual (Yi), or in terms of income, the poorest individual. In this case, society would want to distribute income to the poorest individuals until all incomes were equal.

Another argument is that the rich exploit the poor or otherwise gain unfair benefits , and thus should return some of those benefits. Another argument is that a larger middle class benefits an economy by enabling more people to be consumers, while providing equal opportunities for individuals to reach a better standard of living.

Some proponents of redistribution argue that capitalism results in an externality that creates unequal wealth distribution.[4] They also argue that economic inequality contributes to crime. There is also the issue of equal opportunity to access services such as education and health care. Studies show that a lower rate of redistribution in a given society increases the inequality found among future incomes, due to restraints on wealth investments in both human and physical capital.[5] Roland Benabou states that greater inequality and a lower redistribution rate decreases the likelihood that the lower class will register to vote.[5] Benabou does not find a relationship between levels of inequality and government welfare transfers to the needy.[5]

Some argue that wealth and income inequality are a cause of economic crises, and that reducing these inequalities is one way to prevent or ameliorate economic crises, with redistribution thus benefiting the economy overall, there being synergies. This view was associated with the underconsumptionism school in the 19th century, now considered an aspect of some schools of Keynesian economics; it has also been advanced, for different reasons, by Marxian economics. It was particularly advanced in the US in the 1920s by Waddill Catchings and William Trufant Foster.[6][7]

A system with no redistribution of wealth which adds some measure of redistribution may actually experience a Pareto Improvement, meaning that no persons within the system are worse off and at least one person is better off. Such an outcome is most likely if all high-income people in the system are altruistic in nature, in that they derive some economic utility in giving to the poor. For example, a rich person may experience more utility from giving $100 to the poor than they would have gained had they spent $100 on something for themselves. The poor person receiving the $100 will also be better off. In addition to altruistic reasons, rich persons may support governmental redistribution of wealth: 1) as a form of insurance policy (should they ever become poor, the policy pays off and they are able to collect benefits from the government); or 2) because it improves social stability (lowers crime and rioting among poor people), allowing rich persons to more easily enjoy the benefits of their wealth.[8]

Prospect Of Upward Mobility (POUM) hypothesis

The Prospect Of Upward Mobility (POUM) hypothesis is an argument that explains why some poor and working class voters do not support efforts by governments to redistribute wealth. It states that many people with below average income do not support higher tax rates because of a belief in their prospect for upward mobility.[9] These workers strongly believe that there is opportunity for either themselves, their children, or their grandchildren to move upward on the economic ladder.

There are three key assumptions that form the foundation for the POUM hypothesis. First, one must assume that policies that are enacted in the present will endure into the future and carry enough weight to impact the future.[9] Second, one must assume that poorer workers are "not too risk averse".[9] This assumption rests on the fact that the people in question must realize that their income may also go down instead of up. Finally, poor workers must have an optimistic view of their future, as they expect to go from poorer than the average to richer than average.[9]

After much analysis of the POUM hypothesis, Benabou and Ok recognize two key limitations. One limitation is that other potential problems that create more concavity in the POUM system, such as risk aversion, must not increase too much.[9] Concavity must be kept at a minimum to ensure that the POUM hypothesis generates the expected results. The other limitation is that there must be adequate commitment to the choice of fiscal policy including the government and institutions.[9]

Economic effects

Reduced production: If a tax is paid on outsourced services that is not also charged on services performed for oneself, then it may be cheaper to perform the services oneself than to pay someone else — even considering losses in economic efficiency.[10][11]

The Laffer Curve is a theoretical representation of the relationship between government revenue raised by taxation and all possible rates of taxation. It is used to illustrate the concept of taxable income elasticity (that taxable income will change in response to changes in the rate of taxation). The curve is constructed by thought experiment. First, the amount of tax revenue raised at the extreme tax rates of 0% and 100% is considered. It is clear that a 0% tax rate raises no revenue, but the Laffer curve hypothesis is that a 100% tax rate will also generate no revenue because at such a rate there is no longer any incentive for a rational taxpayer to earn any income, thus the revenue raised will be 100% of nothing. If both a 0% rate and 100% rate of taxation generate no revenue, it follows from the extreme value theorem that there must exist at least one rate in between where tax revenue would be a maximum. The Laffer curve is typically represented as a graph which starts at 0% tax, zero revenue, rises to a maximum rate of revenue raised at an intermediate rate of taxation and then falls again to zero revenue at a 100% tax rate. One potential result of the Laffer curve is that increasing tax rates beyond a certain point will become counterproductive for raising further tax revenue.

Based on economic analysis John Keynes father of Keynesian economics and his followers recommended "pump-priming" the economy to avoid recession: cutting taxes, increasing government borrowing, and spending during economic down-turns.

Supply-side economics is a school of macroeconomic thought that argues that economic growth can be most effectively created by lowering barriers for people to produce (supply) goods and services, such as adjusting income tax and capital gains tax rates, and by allowing greater flexibility by reducing regulation. Consumers will then benefit from a greater supply of goods and services at lower prices.

Typical policy recommendations of supply-side economics are lower marginal tax rates and less regulation.[13] Maximum benefits from taxation policy are achieved by optimizing the marginal tax rates to spur growth, although it is a common misunderstanding that supply side economics is concerned only with taxation policy when it is about removing barriers to production more generally.[14]

Many early proponents argued that the size of the economic growth would be significant enough that the increased government revenue from a faster growing economy would be sufficient to compensate completely for the short-term costs of a tax cut, and that tax cuts could, in fact, cause overall revenue to increase.[15]

Removal of incentives are also possible through too much wealth distribution to the point people choose not to work or work less. In economics and sociology, an incentive is any factor (financial or non-financial) that enables or motivates a particular course of action, or counts as a reason for preferring one choice to the alternatives. It is an expectation that encourages people to behave in a certain way.[16] Since human beings are purposeful creatures, the study of incentive structures is central to the study of all economic activity (both in terms of individual decision-making and in terms of co-operation and competition within a larger institutional structure). Economic analysis, then, of the differences between societies (and between different organizations within a society) largely amounts to characterizing the differences in incentive structures faced by individuals involved in these collective efforts. Ultimately, incentives aim to provide value for money and contribute to organizational success.[17] Many people have suggested alternatives to current wealth redistribution systems where there is no encouragement of those receiving aid to resume working:

What the welfare system and other kinds of governmental programs are doing is paying people to fail. In so far as they fail, they receive the money; in so far as they succeed, even to a moderate extent, the money is taken away. - Thomas Sowell ; During a discussion in Milton Friedman's "Free to Choose" television series in 1980

Deadweight costs of taxation: In the absence of negative externalities, the introduction of taxes into a market reduces economic efficiency by causing deadweight loss. In a competitive market the price of a particular economic good adjusts to ensure that all trades which benefit both the buyer and the seller of a good occur. The introduction of a tax causes the price received by the seller to be less than the cost to the buyer by the amount of the tax. This causes fewer transactions to occur, which reduces economic welfare; the individuals or businesses involved are less well off than before the tax. The tax burden and the amount of deadweight cost is dependent on the elasticity of supply and demand for the good taxed. Most taxes—including income tax and sales tax—can have significant deadweight costs. The only way to avoid deadweight costs in an economy that is generally competitive is to refrain from taxes that change economic incentives.

The Pigou–Dalton principle is that redistribution of wealth from a rich person to a poor person reduces inequality, so long as the order is not switched (the initially richer person is not made poorer than the initially poorer person: they are brought together and not switched). Hugh Dalton suggested further that, assuming no effects other than transfer, such transfers increase collective welfare, because the marginal utility of income or wealth to a rich person is less than that to a poor person. Maximal welfare is achieved if all have equal wealth or income. Dalton's analysis sets aside questions of economic efficiency: redistribution may increase or decrease overall output – it may grow or shrink the pie, not simply change how it is divided.

Others argue that there is a trade-off between equality and efficiency, arguing that redistribution functions as a transaction cost, reducing overall economic output, and should only be done up to the point that the welfare gains from redistribution equal the welfare costs of decreased efficiency (the marginal benefit equals the marginal cost). This view is particularly advanced by (Okun 1975), which uses the metaphor of a leaky bucket, with the water representing wealth or income, and leakage representing efficiency loss.

Current Policy Illustration

Currently in the United States, any means-tested entitlement program can be considered a redistributive effort. This is because the US Government practices a progressive income tax that disproportionately yields public revenues from various earnings brackets. As the wealthy pay more into the system and the poor receive more marginal utility through programs such as TANF, Medicaid, FHA insured loans, and the earned income tax credit (all of which are means-tested), it could be argued that the United States has democratically opted for the redistribution of wealth.

Each of these programs provide services or financial aid to the poor effectively shifting their budget constraint outward, while paying for such

Criticism

Conservative, libertarian and neoliberal arguments against property redistribution consider the term a euphemism for theft or forced labor, and argue that redistribution of legitimately obtained property cannot ever be just.[18] Public choice theory states that redistribution tends to benefit those with political clout to set spending priorities more than those in need, who lack real influence on government.[19]

In the United States, some of the founding fathers and several subsequent leaders expressed opposition to redistribution of wealth. Samuel Adams stated: "The utopian schemes of leveling [redistribution of wealth], and a community of goods, are as visionary and impracticable as those that vest all property in the Crown. [These ideas] are arbitrary, despotic, and, in our government, unconstitutional."[20] James Madison, author of the Constitution, wrote, "I cannot undertake to lay my finger on that article of the Constitution which granted a right to Congress of expending, on objects of benevolence, the money of their constituents."

United States President Grover Cleveland vetoed an expenditure that would have provided $10,000 of federal aid to drought-stricken Texas farmers. When explaining to Congress why such an appropriation of taxpayer money was inappropriate, he stated:

I can find no warrant for such an appropriation in the Constitution; and I do not believe that the power and duty of the General Government ought to be extended to the relief of individual suffering which is in no manner properly related to the public service or benefit. A prevalent tendency to disregard the limited mission of this power and duty should, I think, be steadily resisted, to the end that the lesson should be constantly enforced that, though the people support the Government, the Government should not support the people. ... The friendliness and charity of our fellow countrymen can always be relied on to relieve their fellow citizens in misfortune. This has been repeatedly and quite lately demonstrated. Federal aid in such cases encourages the expectation of paternal care on the part of the Government and weakens the sturdiness of our national character, while it prevents the indulgence among our people of that kindly sentiment and conduct which strengthens the bonds of a common brotherhood.[21]

See also

- Basic income

- Causes of the Great Depression—disparities in wealth and income

- Distribution of wealth

- Gini coefficient

- Living wage

- Nationalization

- Nordic model

- Ownership

- Progressive taxation

- Redistribution

- Redistributive change

- Regressive taxation

- Robin Hood effect

- Sabbath economics

- Social equality

- Social inequality

- Welfare state

Ideologies:

Lists:

US specific:

References

- ^ "Redistribution". Stanford Encyclopedia of Philosophy. Stanford University. 2 July 2004. http://plato.stanford.edu/entries/redistribution/. Retrieved 13 August 2010. ""The social mechanism, such as a change in tax laws, monetary policies, or tort law, that engenders the redistribution of goods among these subjects""

- ^ Harvey S. Rosen & Ted Gayer, Public Finance p. 271-72 (2010).

- ^ Redistribution (Stanford Encyclopedia of Philosophy)

- ^ Marx, K. A Contribution to the Critique of Political Economy. Progress Publishers, Moscow, 1977

- ^ a b c http://www.jstor.org/stable/117283 Unequal Societies: Income Distribution and the Social Contract. Roland Benabou. The American Economic Review, Vol. 90, No. 1 (March 2000), pp.96-129.

- ^ (Dorfman 1959)

- ^ Allgoewer, Elisabeth (May 2002). "Underconsumption theories and Keynesian economics. Interpretations of the Great Depression". Discussion paper no. 2002-14. http://www.vwa.unisg.ch/RePEc/usg/dp2002/dp0214allgoewer_ganz.pdf.

- ^ Harvey S. Rosen & Ted Gayer, Public Finance p. 265-66 (2010).

- ^ a b c d e f [1] Social Mobility and the Demand for Redistribution: The Poum Hypothesis. Roland Benabou, Efe A. Ok. The Quarterly Journal of Economics, Vol. 116, No. 2 (May, 2001), pp. 447-487

- ^ Johnsson, Richard. "Taxation and Domestic Free Trade". Ideas.repec.org. http://ideas.repec.org/p/hhs/ratioi/0040.html. Retrieved 2009-03-27.

- ^ Corsi, Jerome, 2007. "The VAT: Menace to Free Trade", WorldNetDaily Exclusive Commentary, WorldNetDaily, February 3, 2007

- ^ Cite error: Invalid

<ref>tag; no text was provided for refs namedLaffer.2C_A.; see Help:Cite errors/Cite error references no text - ^ Cite error: Invalid

<ref>tag; no text was provided for refs namedWanniski_1978; see Help:Cite errors/Cite error references no text - ^ Brownlee, E. (2006). "Fiscal policy in the Reagan administration". In Kopcke, E.; Tootell, G. M. B.; Triest, R. K.. The macroeconomics of fiscal policy. Cambridge, MA: MIT Press. pp. 117–204. ISBN 0262112957.

- ^ Bartlett, Bruce (2007-04-06). "How Supply-Side Economics Trickled Down". New York Times. http://www.nytimes.com/2007/04/06/opinion/06bartlett.html.

- ^ Sullivan, arthur; Steven M. Sheffrin (2003). Economics: Principles in action. Upper Saddle River, New Jersey 07458: Pearson Prentice Hall. pp. 31. ISBN 0-13-063085-3. http://www.pearsonschool.com/index.cfm?locator=PSZ3R9&PMDbSiteId=2781&PMDbSolutionId=6724&PMDbCategoryId=&PMDbProgramId=12881&level=4.

- ^ Armstrong, Michael (2002). Employee Reward. CIPD House.

- ^ "Redistribution" as Euphemism or, Who Owns What? Philosophy Pathways, Number 65, 24 August 2003, by Anthony Flood

- ^ Plotnick, Robert (1986) "An Interest Group Model of Direct Income Redistribution", The Review of Economics and Statistics, vol. 68, #4, pp. 594-602.

- ^ http://my.opera.com/BAMAToNE/blog/2008/10/29/the-real-sam-adams

- ^ http://www.mackinac.org/article.aspx?ID=7440

- Dorfman, Joseph (1959), Economic Mind in American Civilizationvol 4 and 5.

- Okun, Arthur M. (1975), Equality and Efficiency: The Big Tradeoff, Brookings Institution Press, ISBN 0-8157-6475-8, http://www.brookings.edu/press/Books/1975/equalityandefficiency.aspx